30+ Principal and interest payment

Compare up to 5 free offers now. To calculate the principal and interest portion of the monthly payment first divide the loan amount by 1000.

30 Teacher Cover Letter Cover Letter Example Cover Letter For Resume Cover Letter Teacher

If his monthly payment is 800 per month then 200 will cover the interest part of the payment and the remaining 600 will go toward paying off the principal.

. For example if you take out a loan of 100000 your principal is 100000. Below is an example of a 100000 loan with a 12-month amortization a fixed interest rate of 5 and equal monthly payments of principal interest with a declining total payment. Its the all-in cost of your loan.

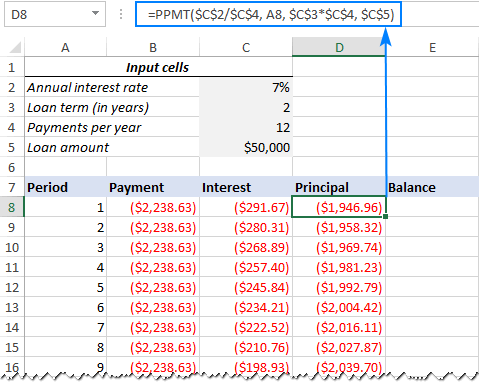

Ad Compare rates pick your best lender close your loan - simple as that. What does Dave Ramsey say about paying off your mortgage. IPMT C8C9C11-C5C12C13 You will get the total interest of the loan provided.

For example if a 150000 loan amount is desired on a 20 year fixed rate then follow these steps. Apply Now With Quicken Loans. Mortgages Arent Just What We Do.

A 100000 mortgage with a 6 percent interest rate requires a payment of 59955 for 30 years. This calculator will help you to determine. 168771 You will need to pay 168771 every month for 15 years to payoff the debt.

Each month a payment is made from buyer to lender. Unless the Bonds are prepaid according to the terms of the Bonds and or recalled according to the agreement required recall the principal and interest of the Bonds will be paid once at the Date of maturity Interest on Bonds will be paid every 12 twelve months from the issue date. Get mortgage rates in minutes.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. That said the business owner will need to pay interest of 200. To be fair Ramsey does not advise paying off your mortgage as a first step.

In essence the lender helps the buyer pay the seller of a house and the buyer agrees to repay the money borrowed over a period of time usually 15 or 30 years in the US. And to get the interest write the following formula and press Enter. Principal and interest payment method.

When the business owner receives his loan proceeds and makes his first payment his loan principal will still be 40000. This Loan Calculator deals with a fixed principal and varying monthly interest payments. The principal refers to the loan amount when you take out a loan.

Things to Remember The period of. If you pay back 50000 assuming no interest your remaining principal is 50000. At todays interest rate of 603 borrowers with a 30-year fixed-rate mortgage of 100000 will pay 601 per month in principal and interest taxes and fees.

The interest is the cost charged by the bank or lender to you to borrow this money. The interest rate on your home loan the loan term and the amount of your repayments will determine how much you end up paying back over the life of the loan. Rates accurate as of September 6 2022.

Alternatively if you paid 150month then 100 would go towards the principal balance. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. To find net payment of salary after taxes and deductions use the Take-Home-Pay Calculator.

To see this click on Payment chart and mouse over any year. Its Who We Are. This means if the loan was for 10000 you would be paying off 600year towards the principal and 600year towards interest and it would take you about 16 and a half years to pay off.

The interest rate is 10 and the payment factors from year 1 to year 30 are. 1 day ago30-year jumbo mortgage rate. The interest and principal paid the remaining balance and the total interest paid by the end of each month are computed.

10 20 30 40 50 60 70 80 90 100 100. Ad Compare Mortgage Options Calculate Payments. Calculate The effect of prepayments.

For instance in the first year of a 30-year 250000 mortgage with a fixed 5 interest rate 1241624 of your payments goes toward interest and only 368841 goes towards your principal. 150000 1000 150. In this scenario you would pay off the debt in just over 8 years.

What are the annual payments for years 1 to 30. Fixed Term Fixed Payments Loan Amount Loan Term years Interest Rate APR Monthly Payment. As you pay this amount back the amount you still have to repay is also known as the principal.

The principal of your home loan is the amount of money you borrow from your bank or lender. The principal payment stays the same each month while the interest payments and total monthly payments decline. 6 hours agoIf the borrower chooses a 30-year loan term theyll be making a monthly payment of 114580 including principal and interest insurance and other expenses are not included in this instance.

By the time of the last payment 30 years later the breakdown would be 369 for principal. Then multiply that number by the principal and interest payment factor. These rates are Bankrates overnight average rates and are based on the assumptions here.

If you double the payment the loan is paid off in 109 months or nine years and one month. More about principal interest payments. You will get the principal amount of the loan given.

A portion of the monthly payment is called the principal which is the original amount borrowed. What is remaining balance at the end of each year. What are the interest payment and principal payment for years 1 to 30.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Principal Recommendation Letter For Student How To Write A Principal Recommendation Letter For Student Do Letter Of Recommendation Student Council Lettering

30 Fabulous Headboard Designs Ideas For Awesome Bedroom To Try Headboard Designs Leather Headboard Cushion Headboard

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Ppmt Function With Formula Examples

30 Professional Promissory Note Templates Notes Template Promissory Note Business Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Free Promissory Note Templates Pdf Word Eforms Free Fillable Forms Promissory Note Notes Template Business Notes

Free Promissory Note Templates Pdf Word Eforms Free Fillable Forms Promissory Note Notes Template Business Notes

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How To Make Principal Only Payments On Student Loans Student Loan Payment Student Loan Forgiveness Student Loans

30 Cover Letter Template Cover Letter For Internship Writing A Cover Letter Marketing Cover Letter

Professional Email Format Templates Professional Email Samples Ecza Solinf Co Formal Business Letter Format Business Letter Format Formal Business Letter

90 Day Entry Plan Template Beautiful The 90 Day Plan A Key To Getting An Fer Ppt Video Preschool Lesson Plan Template Lesson Plan Template Free How To Plan

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

30 Impressive Master Bathroom Remodel Ideas Before After Images Bathroom Remodel Master Bathrooms Remodel Master Bathroom

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed